|

dog health insurance worth it: a practical comparison guideVet costs keep climbing, yet budgets are finite. The question isn't only price - it's fit. Use this comparison to see how plan mechanics, risk, and your workflow line up. What actually drives value- Dog profile: breed risks, age, pre-existing issues, activity level.

- Local pricing: metro ER rates and specialist access can double costs.

- Risk tolerance: do sudden $2,000 - $6,000 bills create hardship?

- Care preferences: are you likely to pursue advanced diagnostics and rehab?

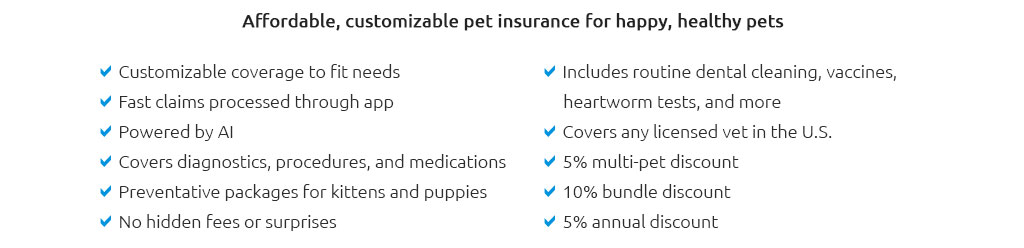

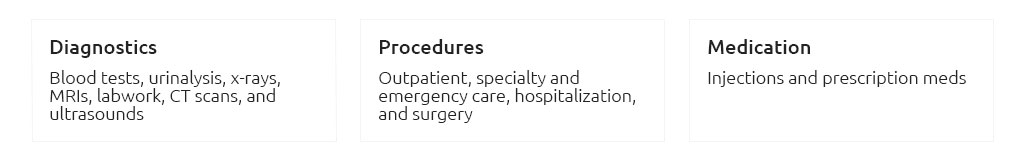

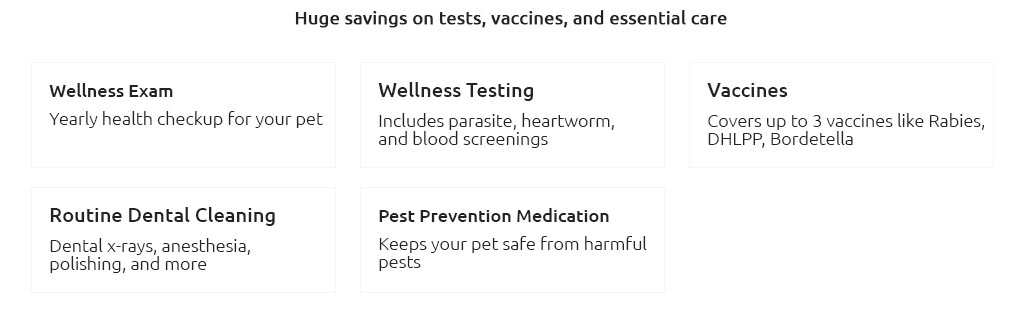

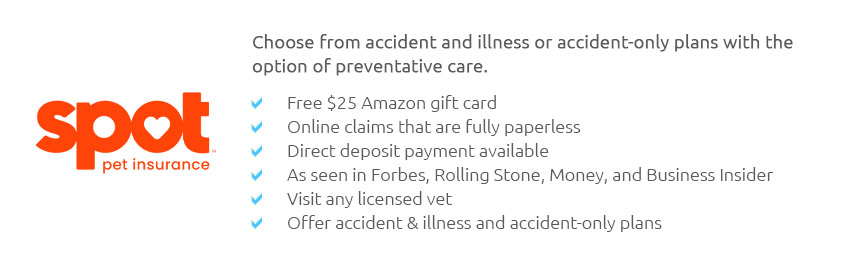

Plan types comparedCoverage shapes both claims and peace of mind. Choose function first, brand second. - Accident-only: cheapest, covers trauma and poisoning; no illness coverage.

- Accident + illness: the core product; cancer, chronic disease, surgeries, emergencies.

- Wellness add-ons: vaccines, exams, dental cleanings; budgeting tool more than a money saver.

Policy levers that change the math- Deductible: annual (most common) vs per-incident; higher deductible lowers premium.

- Reimbursement rate: typically 70% - 90%; lower rate cuts premium but increases your share.

- Annual limit: $5k, $10k, or unlimited; low limits can cap protection in cancer years.

- Waiting periods: accidents short; cruciate/hip often longer with special exams.

- Exclusions: pre-existing conditions, bilateral clauses, breeding-related, some dental disease.

- Fee details: exam fee coverage, Rx/rehab caps, behavioral therapy rules.

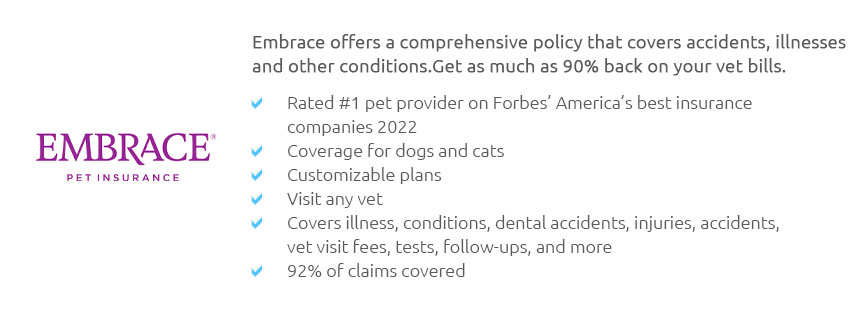

- Provider choice: most let you use any licensed vet; pay vet first, then reimbursement.

20-minute evaluation workflow- Profile your dog: age, breed risks, known conditions, lifestyle hazards.

- Collect 3 quotes with the same settings: deductible, reimbursement, annual limit.

- Normalize settings: pick one trio (e.g., $500 deductible, 80%, $10k limit) so comparisons are apples-to-apples.

- Run three scenarios: routine year ($0 large claims), bad year ($2k - $4k ER + meds), catastrophic ($6k - $10k surgery).

- Calculate your side: premiums + deductible + your coinsurance until the annual limit.

- Check fine print: cruciate/hip wording, dental disease rules, behavioral/rehab coverage.

- Reality check with your vet: ask for typical costs for your breed's top 3 issues.

- Decide your path: insure now (younger = fewer exclusions) or self-insure with an earmarked emergency fund.

- Set a reminder: re-quote in 12 months; premiums and needs change.

A real Tuesday night9:40 p.m., a lab mix swallowed a corn cob. ER visit, imaging, overnight care: $3,600. Policy was 80% reimbursement, $500 annual deductible, $10k limit. Covered amount after deductible was $3,100; reimbursement came to $2,480, paid five days later. Premium was $58/month. One incident outweighed years of calm, but not every year looks like that - some do, many don't. Red flags and fine print to read twice- Pre-existing definitions: look-back windows and "curable" condition rules.

- Bilateral clauses: one knee today can exclude the other knee tomorrow.

- Exam fees: some plans exclude them; others include with riders.

- Dental: injury usually covered, disease often not without specific add-ons.

- Chronic meds: check caps on pharmacy and prescription diets.

- Rehab and alternative care: PT, acupuncture, laser therapy may be limited.

Who often benefits vs who may not- Often benefits: large/giant breeds; young dogs enrolled before issues start; adventurous dogs (hiking, chew-prone); owners far from low-cost ER options.

- May not pencil out: older dogs with existing conditions (many exclusions); ultra-high premiums in certain ZIPs; owners with a robust, disciplined emergency fund and low-risk dogs.

Cost framingYoung medium dogs often see accident+illness premiums around $30 - $80 per month; large breeds, older ages, or dense metros can run higher. ER visits commonly range $800 - $2,000; major surgeries $3,000 - $8,000+; oncology can exceed that. The gap between those numbers and your premium is the decision space. Usable next steps- List breed-specific top 3 conditions and estimated costs.

- Grab three quotes with identical settings and export sample policies.

- Run the three-scenario math on one page; circle the break-even.

- If self-insuring, auto-transfer a monthly amount equal to today's premium into a separate savings bucket.

- Set an annual check-in: health changes, premiums change, your decision can change.

Bottom line (for now)Insurance can convert unpredictable, occasionally massive vet bills into steady, known payments and broader treatment choices. A disciplined savings plan can work too, especially with lower risk. Your dog, your numbers, your threshold - and the answer can evolve rather than land once and for all.

|

|